illinois payroll withholding calculator

You exceed 12000 in withholding during a quarter it is your responsibility to begin to pay your Illinois withholding income tax semi-weekly in the following quarter the remainder of the year. Or keep the same amount.

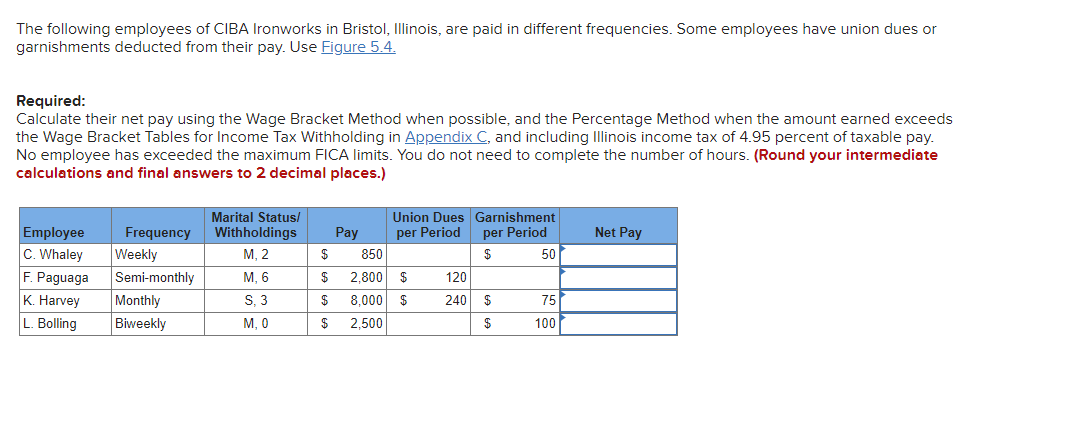

Solved The Following Employees Of Ciba Ironworks In Bristol Chegg Com

If you are married but would like to withhold at the higher single rate please.

. This calculator is a tool to estimate how much federal income tax will be withheld from your gross monthly check. Below are your Illinois salary paycheck results. Free Federal and Illinois Paycheck Withholding Calculator.

Free federal and illinois paycheck withholding calculator. To calculate the total Illinois payroll taxes owed by each employee you will need to determine the percentage of income that should be withheld from local state and federal. Illinois Hourly Payroll Calculator.

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is. Below are your Illinois salary paycheck results. Paycheck Results is your gross pay and specific.

This calculator is a tool to estimate how much federal income tax will be withheld from your gross monthly check. Occupational Disability and Occupational Death Benefits are non-taxable. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line.

This article will help you understand what you need to do to process Illinois payroll for your hourly workers. Instead you fill out Steps 2 3 and 4. The waiver request must be completed and submitted back to the department.

Enter your new tax withholding amount on. The results are broken up into three sections. Our Illinois payroll calculator is designed to help any employer in the Land of Lincoln save time and get payroll done right.

Enter the amount figured in Step 1 above as the total taxable wages on line 1a of the withholding worksheet that you use. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck. The results are broken up into three sections.

Illinois Hourly Paycheck Calculator Results. Illinois Salary Paycheck Calculator Illinois. Illinois Payroll Calculators Calculate your Illinois net pay or take home pay by entering your pay information W4 and Illinois state W4 information.

You can see a list of tax tables supported here with details on tax credits rates and thresholds used in the Salary Calculator Enter your salary or wages then choose the frequency at which. Free federal and illinois paycheck withholding calculator. Illinois Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

All you have to do is enter wage and W-4. Use your estimate to change your tax withholding amount on Form W-4. Payroll Tax Salary Paycheck Calculator Illinois Paycheck Calculator Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Withholding Calculations There are two basic steps to determine how much to withhold for child support from an employees income. The waiver request must be completed and submitted back to the department. To change your tax withholding amount.

Youll use your employees IL-W-4 to.

![]()

Illinois Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Illinois Llc Tax Structure Classification Of Llc Taxes To Be Paid

Toast Payroll Example State Withholding And Ui Correspondence

2022 Federal State Payroll Tax Rates For Employers

Destination Based Sales Tax Assistance Effective January 1 2021 Sales Taxes

Illinois Paycheck Calculator Smartasset

Illinois Sales Tax Calculator And Local Rates 2021 Wise

Economic Development City Of Oglesby

Illinois Payroll Tax Guide 2022 Cavu Hcm

Illinois Sales Tax Rate Rates Calculator Avalara

State W 4 Form Detailed Withholding Forms By State Chart

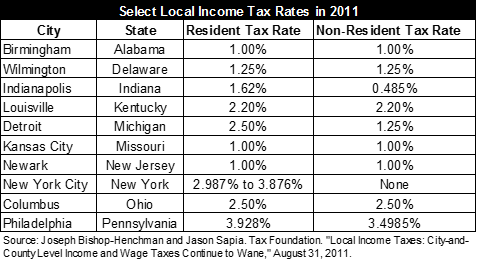

A City Of Chicago Income Tax The Civic Federation

Where S My Illinois State Tax Refund Il Tax Brackets Taxact

Illinois State Form W 4 Download